Are you still paying old rates on your home loans?

Have you taken advantage of the recent rate cuts by the Reserve Bank of India?

Why Balance Transfer?

Balance Transfer is a great way to continue to pay the best market rates on your home loans. No rate of interest is fixed in todays day and age and transferring your loan helps you save on EMI payments and even get more attractive terms on your existing home loan.

In the wake of the world pandemic salaries have been slashed and the bottom line is definitely facing the brunt of this extended period of uncertainty. One of the easiest ways to earn more money is to save more. This is easily achieved if you can move your loan to another bank at lower rates.

The interest/ EMI moratorium was one of the steps that was undertaken by the RBI that ensured there wasn’t a long list of non paying defaulters, when the first few phases of the lockdown went into place. Now with the moratorium set to end and a blanket moratorium seeming unlikely, the focus will shift again on banks and home loan rates.

Whats Next?

With the RBI now announcing that normalcy is returning to the economy, what this means for home loan borrowers is that banks have to now look at passing the benefits of the rate slashing spree that was taken up by the central bank in early May 2020 through their own rate cuts.

The RBI introduced an external benchmark through Repo rates in October 2019. Under the new system the home loan rates will move not at banks choice but with every change that is mandated by RBI. Old internal bench mark rates have not kept pace with reducing repo rates rendering them more expensive than current market rates.

This is therefore the time to look at shifting your loan. In the process you can reduce your EMI, tenure or even both. An additional benefit is that you can also look at additional top up loan at almost home loan rates.

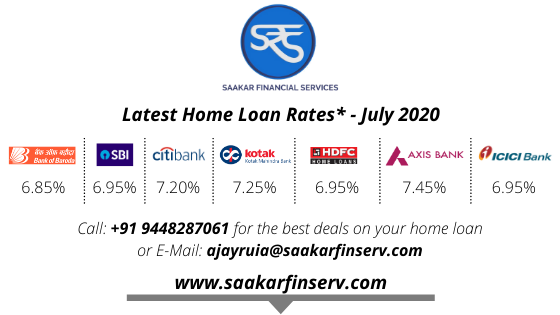

Wondering what are the lowest rates of interest available to you?

Refer to the table below for the lowest rates offered by the top banks in the country at the moment:

“Saakar Financial Services works to get you the best rates of interest and the best terms on your new and more importantly your existing home loans. We bring you offers from more than 25 nationalized and multi-national lenders to match your requirements. Door step service in combination with the best rates of interest will ensure you don’t pay more than what you need to on your home loans.”